Every month the Royal Institution of Chartered Surveyors (RICS) releases its UK Residential Market Survey, providing valuable insights into the current state of the housing market nationwide.

This blog post is bought to you by our Chairman & Managing Director, John King, FRICS, who offers valuable insights from his experience here at andrew scott robertson in Wimbledon Village. He actively contributes his comments to the monthly survey for the London region.

KEY OUTTAKES FROM THE FULL RICS RESIDENTIAL MARKET SURVEY FOLLOWING END OF JUNE RESULTS 2024

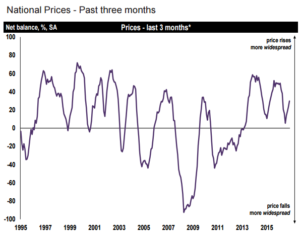

House Prices

Overall, house prices in South London are stabilising, with expectations that interest rates reductions will lead to a rise in values over the next twelve months.

New Instructions

New instructions slowed in June, as many homeowners focused on the pending outcome of the government election.

However, since the announcement changes to the current legislation on lettings will follow shortly. This will lead to some landlords selling their investments with vacant possession when given the opportunity, as increases in capital values picks up later this year it will be seen as a more attractive option.

The outcome of all of this will lead to fewer properties being made available to rent when it does happen.

New Buyer Enquiries

New buyer enquiries tailed off as fewer properties came to the market. Once again with the election, it brought about a wait and see attitude as early signs of an interest rate reduction immediately fade.

Agreed Sales

Newly agreed sales following reductions on asking prices showed increased optimism.

The pace of the market is still unpredictable to gauge but with us we are seeing an offer from every six viewings compared to one in ten over previous months.

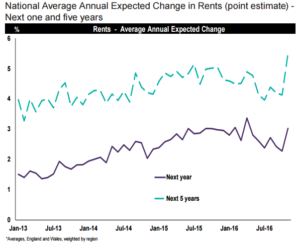

Lettings Market

The lettings market remains consistent with similar tenant registrations month on month. Tenants are challenging asking rents more often on renewals and new lettings. This has meant that landlords and agents have had to raise their standards of the accommodation and service to attract the best tenants.

For more from the RICS UK Monthly Residential Market survey, you can download and read more 2023/2024 reports here: https://www.rics.org/news-insights/market-surveys/uk-residential-market-survey

Please feel free to reach out to us for personalised advice and assistance in this ever-evolving residential market. Find the right team for your needs here.

Regards,

John King, FRICS